9 Timeless Principles of Investing

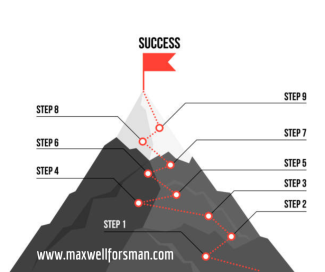

9 Timeless Principles of Investing

1.) Focus On What You Can Control

Market movements, business decisions, economic events, politics, and interest rates—many factors can influence the performance of your investments. Instead of worrying about events that are out of your hands, focus on what's within your control.

- Build an investment strategy that reflects your goal, time horizon and risk tolerance.

- Diversify. But remember diversification is an approach to help manage investment risk. It does not eliminate the risk of loss if security prices decline.

- Manage your tax situation.

2.) Put Time On Your Side

Financial markets have rewarded long-term investors. In 2022, both stocks and the 10-Year T-Bond were under pressure but the hypothetical growth of $100 from 2000-2022 (compounded annually) for example the S&P grew to $400, the 3-Month T-Bill grew to about $150, and the 10-Year T-Bond grew to about $240. Keep in mind, however, that past performance does not guarantee future results, and individuals cant invest directly in an index.

3.) Tune Out The Noise

News cycles driven by fear, uncertainty, and doubt can challenge even the most disciplined investor. Some headlines spark anxiety, while others try to goad you into chasing the hottest fads and trends. Although we live in an era of seemingly infinite data, information overload can cause you to reconsider investment decisions.

4.) Don't Try To Time The Markets

Market timing is the strategy of trying to predict future market movements to time buying and selling decisions. When markets are rallying or pulling back, it can be very tempting to try to seek out the top for selling or the bottom for buying. The problem is that investors usually guess wrong, missing out on the best market days.

Another approach is to focus on time in the markets, which may let you ride out the natural market cycles and focus on your long-term goals.

3 WAYS TO MANAGE MONEY

- Determine Your Time Horizon - Understanding your time horizon is a critical first step in determining what types of investing may fit your overall strategy.

- Be Patient, Not Reactive - It's natural for markets to fluctuate. During periods of volatility, focus on managing your emotions rather then making changes to your portfolio.

- Start Early - The earlier you start, the greater the compounding potential. If you start saving and investing early, you may gain an advantage over someone who waits to save and invest.

5.) Pay Yourself First

Put away at least a minimum amount out of every payday to add to your savings/investments. But this is where the more you put away now, the greater the exponential growth. Get started compounding your investments by reinvesting the capital gains and dividends!

6.) Understand All Forms of Risk

Market risk—or the risk of your portfolio losing value due to factors such as changing market conditions— isn’t the only type of risk to be concerned about. Personal risks, such as longer lifespans and rising healthcare costs, mean that Americans need to consider a variety of factors as they prepare for retirement. Understanding risk as it relates to your time horizon and investing goals is critical to a financial strategy.

7.) Avoid The Emotional Roller Coaster

Emotional decision making can lead to making the wrong decision at the wrong time. A DALBAR study found that while the S&P 500 returned 6.06 percent for the 20-year period ending in 2019, the average investor fared worse, seeing a return of only 4.25 percent during the same period. Emotional decision making was one of the factors that contributed to the difference in performance.

8.) The Cost of Procrastination

The sooner you begin investing, the longer your money can work for you.

Let’s look at two hypothetical investors, Sally Starts and Dave Delays.

When Sally turns fifty, she starts contributing $25,000 a year to an account that earns a hypothetical six percent. After ten years, she stops making payments.

Dave puts off his investing program. At age sixty, he begins putting $25,000 a year into an account that earns a hypothetical six percent.

Though both have contributed equal amounts, Sally has the magic of compound interest working for her. When they both reach age seventy, Sally’s account balance is nearly twice the size of Dave’s.

By starting ten years earlier, Sally is able to accumulate $276,236.00 more than Dave!!!

9.) Delegate The Details

Financial professionals may help you create a customized portfolio strategy that’s built around your unique goals. Although we can’t control markets, we can help you use them to pursue your long-term financial goals.

- Investment strategy development

- Tax-managed investing

- Ongoing portfolio monitoring and oversight

- Regular reviews and responsive service

- Personal portfolio

- Rigorous goals discovery

We are always here as your financial point of light!

Please contact us and let us know how we can help. (856) 582-3500.

1. Stern.NYU.edu, 2023

2. S&P 500 returns include price appreciation and the reinvestment of dividends. Treasury bond returns include coupon and price appreciation. Treasury bill returns are shown at a three-month rate. Past performance is no guarantee of future results. Indexes are not available for direct investment. Historical performance does not reflect the taxes and fees associated with the management of an actual portfolio.

3. TheBalance.com, November 22, 2021 (most recent data available)

4. This example is for illustrative purposes only and does not represent an actual investment or combination of investments. Annual contributions are made at the beginning of the compounding period. This hypothetical example does not reflect taxes or any fees. Past performance does not guarantee future returns